what is suta tax rate

Employers may make a voluntary. The best negative-rate class was.

What Is The Futa Tax 2022 Tax Rates And Info Onpay

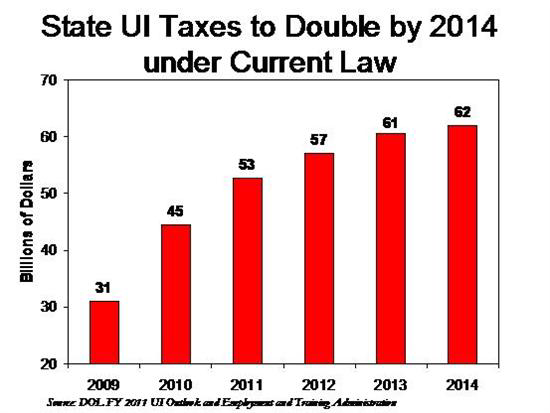

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles. The first component of the tax rate is the experience-based tax which is based on the amount of unemployment benefits paid to. There are two components of the state unemployment tax.

New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the. The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base. State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain.

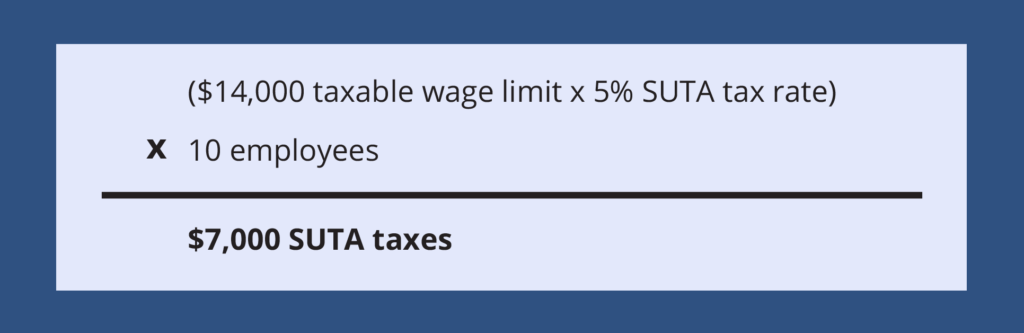

Please note that tax rates are applicable to the first 14000 each employee earns. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee. Taxable base tax rate.

SUTA was established to provide unemployment benefits to displaced. The 54 rate can be earned or it can be assigned to employers who have delinquencies greater than one year and to those employers who fail to produce all work records requested for an. State Disability Insurance SDI and Personal Income.

California has four state payroll taxes. Rates are assigned by calendar year based on the individual situation of the employer. New Virginia employers receive the initial base tax rate of 25 plus.

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year. The rate is based on the ratio between the reserve-balance compared to the average annual taxable payroll for the last three completed fiscal years.

24 new employer rate Special payroll tax. The tax class assignment in the notice should be used for the full calendar year. How are rates assigned.

The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. Lets say your business is in New York where. Although tax rates for each.

The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years. Current Tax Rate Filing Due Dates.

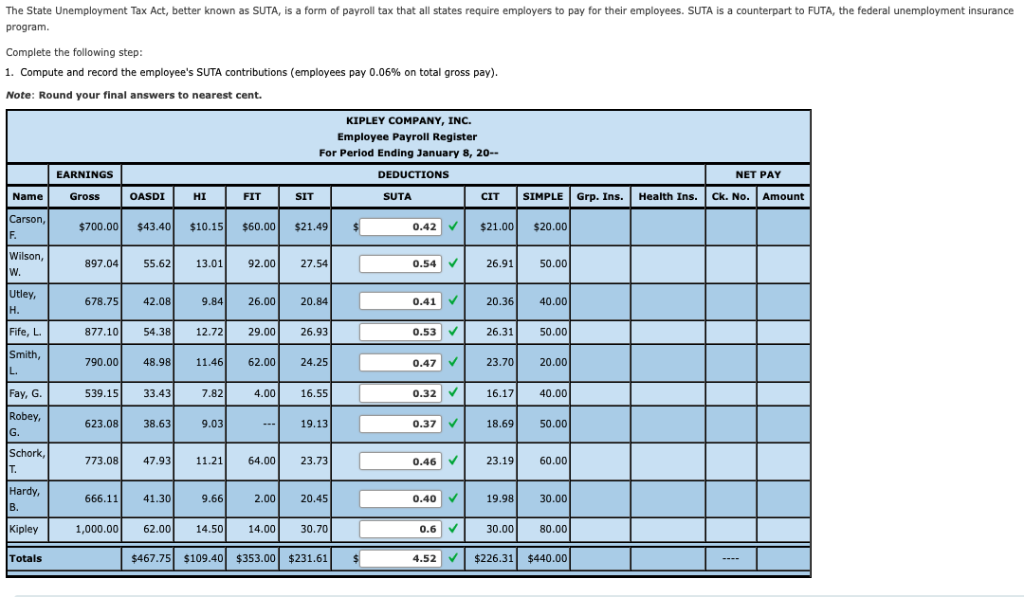

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

Futa Suta Unemployment Tax Rates Procare Support

Futa Tax Overview How It Works How To Calculate

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

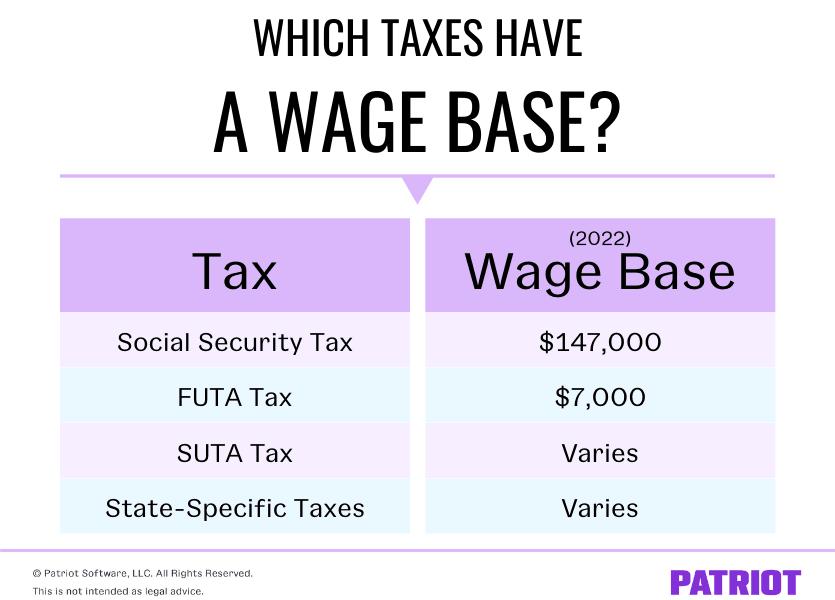

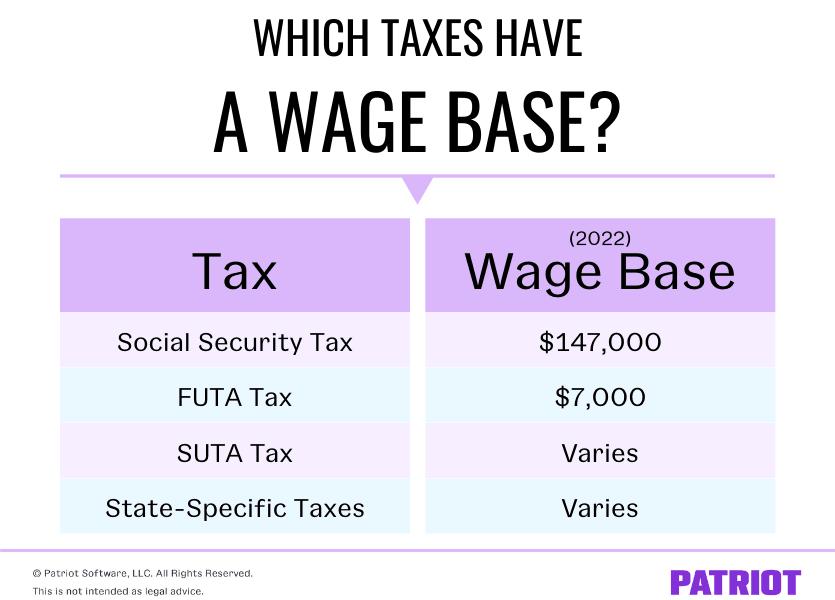

What Is A Wage Base Taxes With Wage Bases More

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

How To Calculate Unemployment Tax Futa Dummies

Oed Unemployment Ui Payroll Taxes

How To Reduce Your Clients Suta Tax Rate In 2014

What S The Cost Of Unemployment Insurance To The Employer

2022 Federal State Payroll Tax Rates For Employers

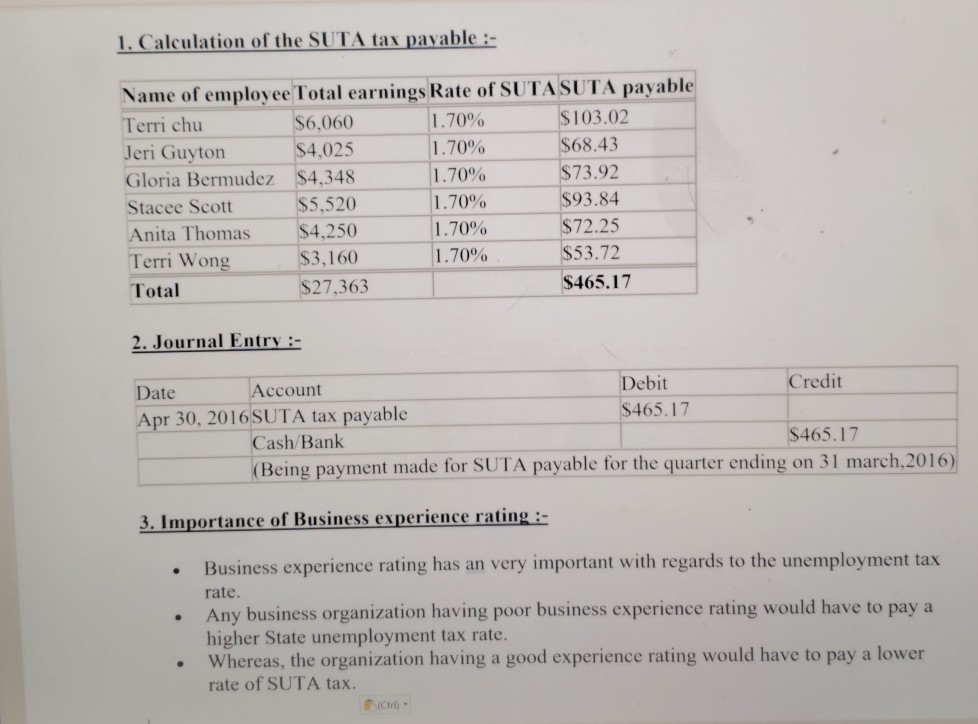

Solved 1 Calculation Of The Suta Tax Payable Name Of Chegg Com